How to file your taxes while teaching for DaDa (US)

By Online Teacher Louise Quigly

Louise Quigley is a writer and online educator from Georgia in the US. She has spent 25 years as an educator/administrator in private and public schools. She is a former freelance correspondent with the Savannah Morning News for over 12 years. She is a mother of 4 and a grandmother of 1. She has a mini backyard farm with chickens/ducks and blogs about it on her FB site: Welcome to Rooville@RoosRuleRooville

What to know before you begin

Hello fellow DaDa educators! Teacher Lou here. It’s that time of year again…tax time. If you are new to online education (like me) you are facing the daunting task of filing those yearly taxes WITHOUT documentation from Dada and not quite sure how to go about it. I want to share my successful experience here as well as some facts and tips to make things smoother.

Many questions have come up: How to file taxes without documentation? Why haven’t I received a W-2 from DaDa? How do I report my income? How can avoid paying a penalty? Will I get a refund? I’ll cover all of this below, but to start off with, there are two important things to be aware of:

First, DaDa does not report taxes to the IRS so the only documentation you have is your banking statements which show as a cash transfer.

Second, when working for DaDa, you are considered a subcontractor – not an employee. This effectively means that we are self- employed and we run our own business as online educators. In the US, if you were hired to do work for someone as a subcontractor you would receive a 1099 statement of payment to file. Since DaDa is a Chinese company they are not beholden to our tax laws and do not report our work for them.

These two things mean that it’s all basically down to you to collect your documents and file taxes yourself. But fear not! Thanks to some online tools it’s not as complicated as it used to be…

Getting your tax software

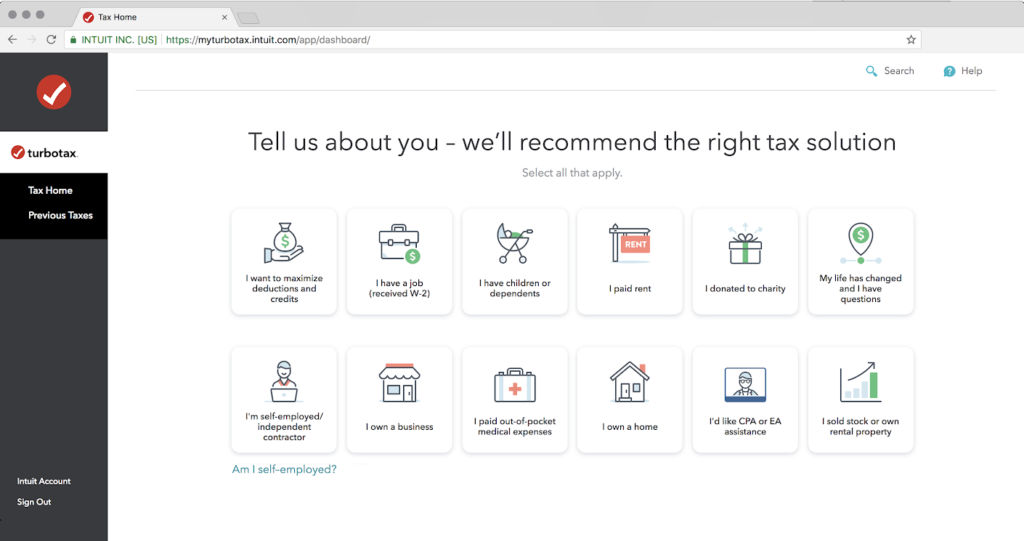

There are several great tools which you can use to file your taxes. I used TurboTax online to file, and this is the tool which i’ll be referring to in this blog post.

TurboTax walks you through the entire process of filing your taxes, and even has live CPAs available to help as well. There are other companies that you can use, but this tool is free in most cases, and makes the whole process easy to understand.

It also makes sure that you don’t miss any deductions – so you pay only what you really need to (more on this later).

Filing your taxes

When you first go into TurboTax, you’ll need to first enter your personal information. After this, you’ll move on to ‘income and wages’. For normal jobs, you’d receive a W-2 (a report covering your wages/salary from an employer). However, since we’re technically self-employed, we don’t receive a W-2 from DaDa, so you’ll need to click on the option for ‘other income or self-employment income’.

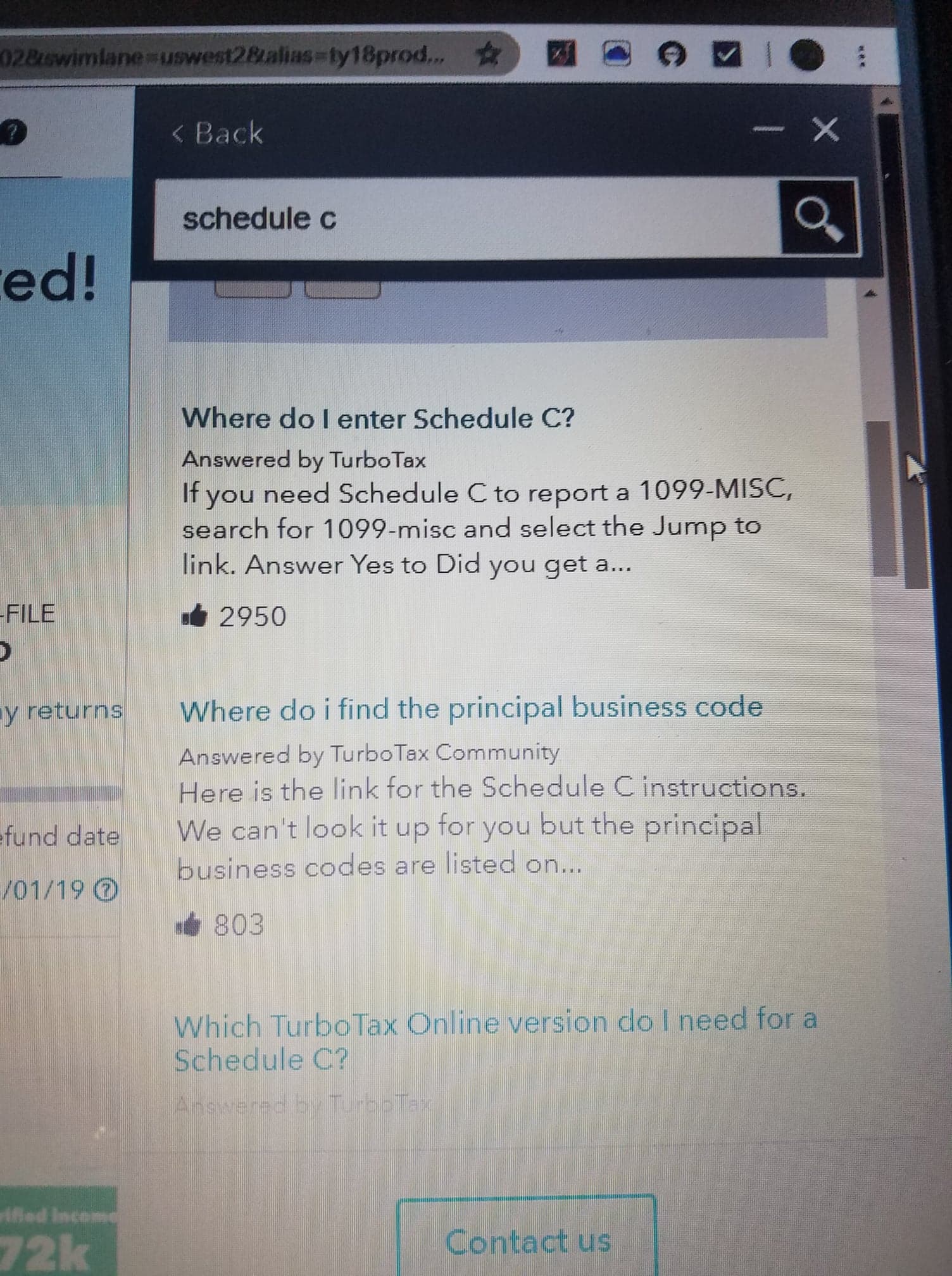

From here, you can select ‘help’ at the top of the page and type in ‘Schedule C (profit/loss from business)’. The tool will ask you if you want to go to Schedule C – to which you can click ‘yes’.

It will take you to the ‘profit/loss from business’ section. HERE is where you put your DaDa income.

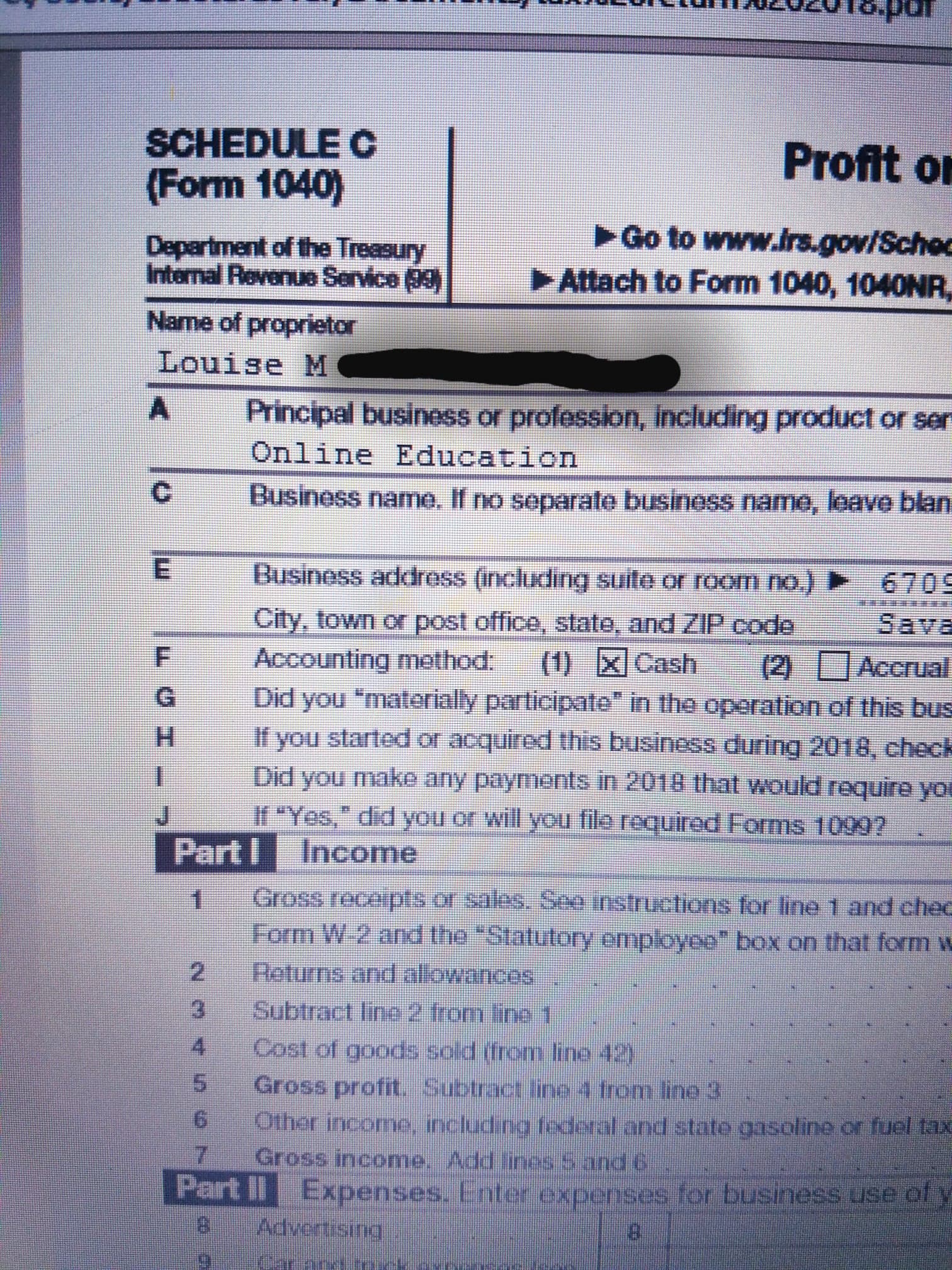

It will ask your business name. Do NOT put DaDa ABC – as DaDa isn’t your company, it’s a client which pays for your teaching services. Instead, you should put ‘ONLINE EDUCATOR‘, and enter how much you made with DaDa last year – including January’s check for December.

Adding your deductions

Once you’ve done entering your earnings, you can move onto entering your deductions.

Anything and everything you use or have used for your classroom including the SPACE is tax-deductible. This means that you can offset the costs of these things against your earnings – resulting in a lower tax bill at the end.

With this in mind, you’ll want to spend a bit of time making a list of everything you bought last year to aid in your teaching ‘business’. Here are some of the things to include:

Materials: All of the props, classroom decorations, flashcards, paper, toys, markers, and whiteboards.

Equipment: Your laptop, webcam, headset, table, chair, storage equipment, antivirus software, trash bins, cleaning products.

Renovations: You can also include the costs of any renovations made to your workspace – painting, lights, curtains/blinds, flooring etc.

Utilities: You can write off ALL utilities/insurance/property taxes/security and even pest control. Yes! Even post control. You’ll need to figure out what you spent on all utilities etc. for the year, then the tax program will automatically figure out the portion used for your classroom space.

Classroom space: We all use a home office albeit it the kitchen counter, a guest room or even a space in your attic. Take a minute to measure the square footage of the ENTIRE space/room. The program will automatically figure what percentage of your whole apartment/house can be written off as a tax-deductible.

You’ll often be surprised at how many things you’ll have paid for at the end of the year, so it’s really important to include them when filing for your taxes. However, it’s also important to make sure that you don’t include items which don’t actually have any relation to your work with DaDa. For example, if you did any renovations to another room, you can’t include these costs in your deductions.

Submitting your forms

Once done with this section you are finished with your declaration! Just complete the rest of the forms (health Ins etc) like you would any other time. After this, you’ll have successfully claimed your business income and all deductions! Also, this will all transfer over to state automatically!

Once again, you do NOT have to have a 1099 or W-2 from your foreign online company to file taxes. Just a record of money earned. The IRS will be happy that you are reporting the income and not hiding it. You also do NOT need an actual tax paper from your online company. As long as you have a record of deposits be it Paypal, Transferwise or your bank, you have your ‘paper trail’ right there.

Remember, Schedule C is your best friend! Use it wisely! (And thoroughly).

PS- both my federal and state taxes have been accepted already! 😁

Rated 97% on GoOverseas!

Rated 97% on GoOverseas!

Thank you! This helps so much, especially since I hate filling in tax forms and never can tell what they want! You ROCK!!! Thank you again for the step-by-step help! 🙂

Thank you so much for this information! Now I know what to file for this year!

Thank you for all the helpful advice. I really needed it this year. Thanks again.